If you want to be a successful investor, you should be able to watch paint dry on a wall, said Mohnish Pabrai in one of his interviews quoted in the book, Richer Wiser Happier.

I found this intriguing. Today, when most “investors” are buying meme stocks and betting on cryptocurrency, this guy was asking to be patient.

My knowledge largely comes from Warren Buffett and Charlie Munger who advocate patience in investing, similar to Mohnish Pabrai. One of the anecdotes that Charlie shared was comparing fishing to investing. “You stand in the water with your hook lined up, and you wait and you wait”, said Charlie, “you wait until you see a big salmon swimming by. Then you strike.”

My initial reading of Mohnish Pabrai also involved a lot of similar advice. So I had to dig deeper to understand Pabrai’s investment strategy. And I am glad I did.

Over the past 2 months, I have been consuming content from Mohnish Pabrai at some scale. I have been sleeping while binge-listening to his interviews on YouTube. Yep, the soothing voice of Mohnish Pabrai declaring his love for asymmetric bets. I have been reading through his blog and books (more on that below). And of course, there is his Twitter where he shares photos of him standing next to his Ferrari with the Dhandho number plate.

I wanted to share some lessons learned from Mr. Pabrai on investing and life that I have learned through consuming various forms of content.

If you are here only for the summary of lessons from Mohnish Pabrai, here it goes.

Buy existing businesses which are simple and inside your circle of competence. Wait patiently for the big salmon to swim by, when it does, strike. And strike hard. Place big bets, infrequent bets. Only place bets when you have an advantage. You should get a dollar’s worth of assets for less than a dollar. And never forget – heads, I win; tails, I don’t lose much!

Richer, Wiser, Happier

When I picked Richer, Wiser, Happier this month (again through a recommendation from Mr. Pabrai), I was happy to see the first chapter dedicated to his life and investment philosophy. The book lays out the 5 rules that he uses in life and investments.

Rule 1: Clone like crazy

Mr. Pabrai’s philosophy is simple. When he started investing, he correctly realized that there were smarter people than him who had been in the investment ‘game’ far longer than him. So why not copy them?

He calls this cloning.

Obviously, it’s not mindless copying. He does his due diligence. I would call it reverse engineering. If Uncle Warren buys something, he tries to understand why this very brilliant investor bought that particular security. What does Uncle Warren see that I don’t?

Similar to the concept of the Circle of Competence by Warren Buffett, Mohnish Pabrai has learned cloning from him.

Buffett has said, “If you learn, basically, from other people, you don’t have to get too many ideas on your own. You can just apply the best of what you see.”

So why doesn’t everyone do it? Mohnish answers that too. They have more ego.

To be a great cloner, you have to check your ego at the door.

Mohnish Pabrai

He calls himself a shameless cloner. Mr. Pabrai doesn’t apply cloning only to investing but applies it to his life as well.

What I learned a long time back is, keep observing the world inside and outside your industry, and when you see someone doing something smart, force yourself to adopt it.

Mohnish Pabrai

He has cloned decision-making from Charlie Munger and leveraged a lot of his mental models. When he was setting up his fund, he even cloned the way Berkshire Hathaway was set up. Mohnish also started the Dakshana Foundation (more on that below); when it was time to write the first annual report, he cloned Uncle Warren, again.

It’s simple. If someone does something well, learn from them. Clone them.

Rule 2: Hang out with people who are better than you.

We all have heard the age-old cliche, if you are the smartest person in the room, you’re in the wrong room. Mohnish Pabrai has taken this to his heart.

He paid $650,000 for lunch with Warren Buffett. Mohnish says that lunch is still paying him dividends. You can see from his videos that he is a long-term person with long-term friends.

Rule 3: Treat life as a game, not as a survival contest or a battle to the death.

When I was reading the Dhandho Investor, written by Mohnish Pabrai, it was pretty evident that he lives by this rule.

He views life in bets which sparked a change in my own thought process. There are upsides and downsides to all your decisions. And you should view it that way.

Mohnish built TransTech on the side while working full-time at Tellabs. When he started getting clients, he decided to leave Tellabs and make TransTech his full-time job. But he did this with an agreement with his manager at Tellabs – they will take him back and here’s the kicker, at a higher salary!

This is true for all the bets Mohnish places in his life.

Big but infrequent bets. And it’s all about only participating in coin tosses where “heads, he wins; tails, he doesn’t lose much!”

Rule 4: Be in alignment with who you are; don’t do what you don’t want to do or what’s not right for you.

Mohnish keeps his calendar mostly free. He doesn’t hire any analysts to do his job. He doesn’t talk to anyone he doesn’t want to. It doesn’t align with him.

He likes taking afternoon naps, reading, and playing bridge. He reads annual reports and books throughout the year. Patiently. And when it’s time to strike, he strikes.

He is in alignment with what he does.

I used to go out a lot out of social obligations. But at this point in my life, I apologize and say I can’t come. If I don’t want to, I don’t. It’s a good framework.

How do you determine if you want to do something or not? Use Derek Sivers’ ‘hell yeah’ framework. If it’s not a hell yeah, say no.

Rule 5: Live by an inner scorecard; don’t worry about what others think of you; don’t be defined by external validation.

Where do I even start on this? He cloned this framework from Charlie Munger who is known for his wit and candid responses. Charlie lives by an inner scorecard. If he is in alignment with who he is, he doesn’t need external validation.

One way to tell whether you live by an inner or outer scorecard? Buffett has the answer.

Would I rather be the worst lover in the world and be known publicly as the best, or the best lover in the world and be known publicly as the worst?

Warren Buffett

It’s all about your personal happiness and well-being.

As Shane Parrish puts it in his article on Farnam Street, “problems arise when we start compromising our own standards, those we have set for ourselves, in order to earn the admiration of others. Problems come when we choose to focus on what others think and see versus reality.”

The big question about how people behave is whether they’ve got an Inner Scorecard or an Outer Scorecard. It helps if you can be satisfied with an Inner Scorecard.

Warren Buffett

Who is Mohnish Pabrai?

You’ve been reading through and his rules are definitely interesting. It’s something you have never come across. So the question is obvious. Who the hell is Mohnish Pabrai?

He is an American-Indian investor born in Mumbai in, guess what, 1964! Damn you, Jeffrey… Jeffrey Bezos.

Mr. Pabrai at TransTech

Mohnish worked in Tellabs in the IT sector. While working full-time at Tellabs, he started his own business seeing an opportunity that could leverage IT knowledge from India in the midwest USA. He jumped on this opportunity. He would work on his side business from 6-8 am, work at Tellabs from 8-5 pm, and then again work on his side gig until midnight. In his book and so many of his interviews, he says, “I used to live off a Subway throughout the day. I was not in a relationship. So over the weekends and after work, I used to work on the side business”.

In 1991, he made his side gig full time under the name TransTech. As mentioned before in Rule#3, he made the switch using his philosophy of “heads, I win; tails, I don’t lose much.”

He used 30K from his 401K and another 70K on his credit cards to start the business. By 1996, TransTech was recognized as an Inc. 500 company – one of the 500 fastest growing businesses in the United States!

In 2000, he sold this company for $20million.

Pabrai Investment Funds

During his time at TransTech, he stumbled upon this book by Peter Lynch called One Up On Wall Street which introduced him to the world of investment. More importantly, he found out about Warren Buffett.

When he started learning about Warren Buffett, he realized uncle Warren was compounding at almost 30% year over year. Being a student of Indian history, Mohnish had read the story of the gift of rice by the Indian king.

As the story goes, when chess was presented to a great king, the king offered the inventor any reward that he wanted. The inventor asked that a single grain of rice be placed on the first square of the chessboard. Then two grains on the second square, four grains on the third, and so on. Doubling each time. By the time it reaches the 64th square, the king would have had to put in more than 18,000,000,000,000,000,000 grains of rice which is equal to about 210 billion tons. That’s the power of compounding.

Mohnish Pabrai was sharp enough to realize that Buffett would soon become the richest person in the world. He decided to clone him (Rule #1). His thought process was simple. Even if he doesn’t compound at 30%, he can surely compound at 26%. As a reminder, he drove a car with the number plate ‘COMLB 26’ which is short for COMPOUND 26 (LB stands for pound).

He started Pabrai Investment Funds and the rest is history. Mohnish has had a stellar return of 25.7% over the past 18 years (source). Pabrai Investment Funds, as of 2021, manages $638.6 million in assets (source).

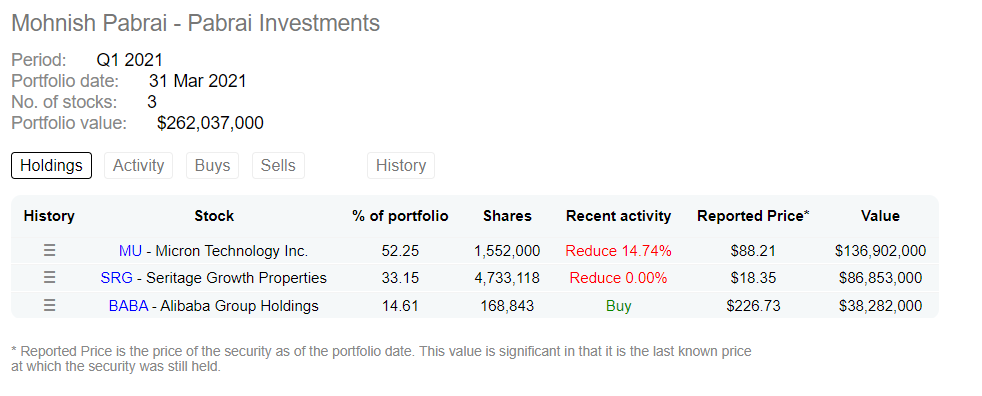

Mohnish Pabrai’s current portfolio from his 13f, as of Q1 2021, consists of three shares (source).

Again aligning with his investment philosophy, big but infrequent bets.

Mohnish Pabrai still considers his $650,000 lunch as one of the greatest investments which he bought in 2009 as ‘guru-dakshina’ to his guru, Uncle Warren.

Mohnish starts the Dakshana Foundation

He also started the Dakshana Foundation which teaches under-privileged students and prepares them for IIT examinations. The students move to Dakshana Valley where they are given all the resources to succeed in the exams.

If you’re a Bollywood fan, you would quickly recognize this as the story of Anand Kumar and his class of Super 30. With Anand’s blessing, Mr. Pabrai started the Dakshana Foundation but on a scale.

In 2016, the cost of a scholar at Dakshana was $2,649 and its success rate was an astonishing 85%. This is better than most of the classes in Kota!

One of the more important lessons I have learned is being patient. You don’t need to generate millions of ideas. Just a couple per year which will make you rich. But when these ideas come, bet large on them. These ideas need to be in your circle of competence, which is different for each individual.

The Dhandho Framework

My lessons were carved in stone when I picked up Dhandho written by Mohnish Pabrai this month. All the notes I was taking by consuming hours and hours of content were laid down by the man himself in this book about business (dhandho literally translates to business in Gujarati).

His Dhandho Framework is famous which I have detailed below.

Focus on buying an existing business

Starting a new business is always difficult, there is a lot of heavy lifting initially. If you buy an existing business through a stock purchase, you have quite a few advantages including the business is already running and staffed. In addition, you don’t need as much capital to buy an existing business as compared to starting something new. Imagine, you can now buy fractional shares!

Buy simple businesses in industries with an ultra-slow rate of change

Understand your Circle of Competence. You don’t have to know the size of your circle but know your boundaries. Invest only within your circle of competence.

As Pabrai, your goal should be to say no. If you don’t understand a business and it’s too complex, don’t invest.

Technology might be simple for a few. Retail might be easier for others. Be mindful of the businesses you understand.

I’m no genius. I’m smart in spots—but I stay around those spots.

Tom Watson Sr.

Buy distressed businesses in distressed industries

The entrance strategy is actually more important than the exit strategy

Eddie Lampert

As I stated above, one of the important lessons I have learned from Mohnish is patience. He waits for the right opportunity. The right opportunity in the markets comes in distress.

Let’s take the COVID-19 crash in March 2020 as an example. If you were patient and held your capital, the entire market was at a discount for a month. As Buffett might put it, “I feel like an oversexed man in a harem. This is the time to start investing.”

Using the framework, you have eliminated 1. complex businesses, 2. businesses that are outside your circle of competence, and 3. businesses that are not at a discount. What remains is a handful of businesses in the market. You analyze them using the remainder of the framework.

Buy businesses with a durable competitive advantage – The Moat

I don’t want an easy business for competitors. I want a business with a moat sound. I want a very valuable castle in the middle and then I want the duke who is in charge of that castle to be very honest and hardworking and able. Then I want a moat around that castle

Warren Buffett

Atit and I have done an episode explaining moats which you can listen to here.

Moats are nothing but businesses with a competitive advantage. A moat protects a fortress and similarly, it does to a business. An example could be Apple with its ecosystem or Nike with a brand moat. It’s difficult for a competitor to overcome these advantages.

Buy a business with a durable moat.

The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and above all, the durability of that advantage

Warren Buffett

Bet heavily when the odds are overwhelmingly in your favor

The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.

Charlie Munger

Big, infrequent bets. If you have been following the framework, the odds of an asset being in your favor are low. Overwhelmingly in your favor, rare!

When you find such a business, bet heavily.

Focus on arbitrage

The elimination of downside risk, even if upside is limited, is awesome – and that’s exactly what arbitrage gives us.

Mohnish Pabrai

For a Dhandho arbitrage, look for businesses with duration and width of the spread of arbitrage. It’s similar to a business with a competitive advantage.

Buy businesses at big discounts to their underlying intrinsic value

Get a dollar’s worth of assets for far less than a dollar

Mohnish Pabrai

Mohnish doesn’t look for businesses that have a 10% discount. He looks for businesses selling at a 30-50% discount on the market. Again using the “look for business in distress” framework.

The discount is essentially your Margin of Safety. Coined by Ben Graham, Margin of Safety essentially is the difference between the intrinsic value of a stock and its market price.

You can use a discounted cash flow model (explained here by Cold Brew Money) or behind the napkin calculation. But look for businesses with a large margin of safety.

Look for low-risk, high-uncertainty business

Mohnish in the Dhandho framework advises looking for businesses that are selling at a discount owing to uncertainty. The downside is very low and the upside potential is large.

Heads, I win; tails, I don’t lose much!

Let’s take the current example of Alibaba. Owing to the changes to the Chinese regulations (my friend Thomas has written an in-depth article on his blog) has taken a beating. At the same time, a lot of investors such as Pabrai and Munger have bought huge stakes in Alibaba. I am assuming they are seeing a huge discount in a low-risk, high uncertainty business.

It’s better to be a copycat than an innovator

If you learn from, basically, from other people, you don’t have to get too many ideas on your own. You can just apply the best of what you see.

Warren Buffett

Per the Dhandho framework, innovators are rare and risky. Ignore them. Always seek out businesses run by people who have demonstrated their ability to repeatedly lift and scale.

Overall, I have been really impressed by Mohnish Pabrai, his personality, and his lessons. Only in a few months, he has made a huge impact on my life. As I continue learning more about him, I will definitely keep y’all posted. But in the meanwhile, here are some additional resources if you want to clone my journey.

More reading material

YouTube – Mohnish Pabrai – for an investor running a $600 million fund, his channel is updated often with the latest interviews

YouTube – YAPSS – they have an entire playlist dedicated to interviews from Pabrai.

Book – Richer, Wiser, Happier by William Green – gives a great overview of lessons from top investors, including Mohnish Pabrai

Book – The Dhandho Investor by Mohnish Pabrai – explains the above framework in a lot more detail

You can donate to the Dakshana Foundation by clicking here.